The Bank of Japan continues to maintain extremely low levels of short- and long-term interest rates even as external risks to the economy increase and the potential growth rate hovers at as low as 1% per year. Kojima Akira comments on six years of monetary easing and the policy’s emerging side effects.

Interest as the “price” of money has been decreasing steadily. In more than ten countries around the world, including Switzerland, Germany, France and Japan, government bonds are now trading at negative yields. Looking back, a number of episodes or stories related to high interest rates can be found, including the one with Shylock in a play by Shakespeare. Today, however, our interest rates remain in negative territory or hover close to zero, making it difficult for banks to remain profitable through traditional loan business. It was only a few years ago that interest rates fell below 2%, which was compared to the interest rates that prevailed during the Middle Ages in Genova, Italy. Surprisingly enough, we are now seeing interest rates “remaining below the surface of the water.”

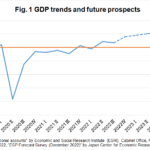

The Bank of Japan launched a so-called quantitative/qualitative drastic monetary easing policy in April 2013, with the aim of overcoming deflation and bringing the economy back to a sustainable growth path as soon as possible. Meanwhile, the central bank set the target of achieving price stability of 2% in terms of the year-on-year rate of change in the consumer price index within about two years. This policy was initially meant to be a short-term strategy for bailing the economy out of deflation. Six years have passed since then, but the annual increase in the consumer price index still remains low, at around 1%. In particular, the potential growth rate, which reflects the growth capacity of Japan’s economy, is hovering around as low as 1% per year.

Lending money without charging any interest as its price would mean that there was no price mechanism functioning in the financial markets. With a strong sense of crisis in the face of this situation, the Federal Reserve Board (FRB), the central bank of the United States, has announced a series of interest rate hikes with the aim of achieving a recovery in the interest rate function since it implemented an interest rate cut in December 2008 following the collapse of Lehman Brothers. More recently, however, the US central bank raised the interest rate for the first time in ten years and six months in July 2019, given the growing downside risks in the economy amid the US-China trade disputes along with the political pressure from the Trump administration to cut interest rates. Other industrialized nations have since appeared to follow the US move by introducing further easing in their monetary policies.

Looming Concerns

It appears that the BOJ is determined to stick to its existing monetary policy with more easing than any other countries have introduced. However, it seems to be the case that the unconventional monetary easing policy, which has been underway for a long time, is beginning to have side effects on the financial as well as the securities markets. Furthermore, there is an increasing number of banks that are finding it difficult to secure revenue and profit due to sluggish loan demand, even without charging any interest. While banks in Japan have cut the deposit rate to near zero, some financial institutions are looking to introduce a de facto negative interest rate in the form of handling commissions to keep individual deposit accounts open.

Given the aging population in Japan, its public pension scheme is faced with overall challenges with low investment yields. In the face of this situation, there appear to be some looming concerns that the non-traditional monetary easing policy could end up having adverse side effects without achieving successful results.

Market anomalies that have taken place as a result of the BOJ’s easing policy are suggested by the following data. The BOJ has been purchasing government bonds in the amount of 50 trillion yen each year since April 2013. As a result, it holds 43% of the government bonds outstanding as of the end of March 2019. The BOJ has been snapping up new issues of the government bonds, and they “evaporate” from the market as soon as they are issued.

The BOJ has become a major shareholder in some of the listed companies. While it is obvious that the central bank is not allowed to purchase individual issues, it has been purchasing an increasing amount of equity trust funds (ETFs) linked to the stock market.

Stock prices and long-term interest rates are often referred to as the barometer of the economy. However, this barometer appears to have started losing its accuracy as an indicator.

It seems that some other countries are beginning to realize that it is difficult to achieve successful easing results even with the introduction of negative interest rates, causing concerns about “Japanization” in the finance sector. Money without interest being charged reflects the lack of investment opportunities. In this sense, some experts warn that capitalism is commencing a fall that will continue for a long time to come. Some others warn that monetary easing programs could cause a distorted bubble to form in the global economy again.

KOJIMA Akira is a member of the Board of Trustees and professor of the National Graduate Institute for Policy Studies

[This article first appeared in the November/December issue of the Japan Journal.]