Venture capital spending by major Japanese companies has reached record levels. Odaki Kazuhiko examines what the investment boom might mean in the long term for the Japanese start-up beneficiaries and the domestic economy as a whole.

For a long time, competent young people in Japan have shown a strong tendency to join large companies, rather than starting up businesses. Business ventures are currently enjoying a boom in this country. More and more young people are hoping to start a business while at school or are attempting to strike out on their own after working at a well-known company for a short period upon leaving school. To be sure, fewer than 100 companies list shares on securities markets each year. This number is about half of the same figure before the global financial crisis. However, cases in which businesses are sold to large companies through mergers and acquisitions are increasing rapidly in number. Companies such as those operating easy-to-use websites for job changes, those carrying out clinical trials for others and those taking charge of the suitcases of foreign tourists visiting Shibuya are raising funds amounting to 100 million yen or 200 million yen from venture capital companies in succession. Students at the University of Tokyo and Kyoto University are doing things like developing a smartphone application, launching a company around the application and selling it for 100 million yen.

For a long time, competent young people in Japan have shown a strong tendency to join large companies, rather than starting up businesses. Business ventures are currently enjoying a boom in this country. More and more young people are hoping to start a business while at school or are attempting to strike out on their own after working at a well-known company for a short period upon leaving school. To be sure, fewer than 100 companies list shares on securities markets each year. This number is about half of the same figure before the global financial crisis. However, cases in which businesses are sold to large companies through mergers and acquisitions are increasing rapidly in number. Companies such as those operating easy-to-use websites for job changes, those carrying out clinical trials for others and those taking charge of the suitcases of foreign tourists visiting Shibuya are raising funds amounting to 100 million yen or 200 million yen from venture capital companies in succession. Students at the University of Tokyo and Kyoto University are doing things like developing a smartphone application, launching a company around the application and selling it for 100 million yen.

Unlike their counterparts in other parts of the world, these venture companies have limited growth potential. As a matter of fact, none of the companies that have raised funds in this way appears to be growing into an international business venture. They have not improved the level of information technologies in Japan. It is not the case that business ventures on the side of obtaining supplied funds have improved anything.

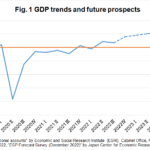

So why is the number of business ventures increasing rapidly in Japan today? The main reason is that funds are easy to raise. Huge amounts of money are invested in business ventures in Japan. There are not many investment targets for banks and companies in Japan, where domestic growth opportunities have decreased. Under the circumstances, the Bank of Japan (BOJ) and pension fund administrators are buying government bonds, real estate investment trusts (REITs) and investment packages based on stock indexes. As a result, many private operating companies in Japan are left with few options for traditional fund management. They also find few investment targets based on their main businesses. Under these conditions, those companies in Japan are increasing their investments in business ventures.

The 10-trillion-yen venture fund launched by SoftBank Group last year had the strongest impact on the supply of funds to business ventures in Japan. SoftBank Group CEO Son Masayoshi is also highly rated as a venture capitalist. He made huge investments in the early growth stages of Yahoo in the United States and Alibaba in China, and had owned more than 30% of the outstanding shares of these two companies. Under the command of CEO Son, SoftBank Group began making colossal investments in business ventures amounting to 10 trillion yen, which is equivalent to the sum of venture capital in the United States. There are many companies following in the footsteps of SoftBank and starting to invest in venture firms. Fund suppliers are already scrambling to make investments in ventures proposed by promising business founders in the fund-raising community for business ventures. This tendency has transformed Japan into the easiest country in the world for business ventures to raise funds at present.

Investments in venture companies in Japan have reached a state that reminds observers of the dot-com bubble in the United States in 1999. Venture companies are able to raise huge amounts of funds by issuing a small number of additional shares. Although they employ engineers and manufacture their products, these ventures are also enthusiastic about investments in other business ventures. They must have raised funds from venture capital companies because they were short of the funds needed for starting a business on their own. However, they invest the funds raised in other business ventures and make profits from the sale of shares in those ventures. They sell those startups to other venture companies as well. Funds supplied by the BOJ and SoftBank are bringing cyclical benefits to the ecosystem of Japanese business ventures in this way.

Too many business ventures without capabilities due to this excessive supply of funds are certainly unsound. However, not everything about this phenomenon is bad. This business venture investment boom will probably end before long. Many investors will be aware that the money they have invested has produced nothing more than PowerPoint materials created by irresponsible young people. They will suffer a huge loss. However, the US dot-com bubble, which pampered many young people and supplied them with huge amounts of funds, was by no means useless. Members of PayPal who sold the tiny website for remitting auction fees for an exorbitant price just before the burst of the dot-com bubble in the United States used the funds to start a large number of successful businesses. There is an extremely strong possibility that the university students selling a smartphone site for 100 million yen today will become competent entrepreneurs in the future in the same way. This business venture investment boom is functioning as an important subsidy for them. I believe that the boom will contribute to Japan’s future growth.

ODAKI Kazuhiko is a professor at Nihon University and senior fellow at the Research Institute for Economy, Trade and Industry.